A Confluence of Events Keeps the Market Moving

November 20, 2018

Authors: Cody Hagerman and Rob Marton

Publishers: HFO Apartment Investor Newsletter

With rents flattening and vacancies increasing, what otherwise could have been a year of “holding tight” on investment properties was instead a hectic one. As we examine in this newsletter, the combination of increased market regulation, rising interest rates, and the cost of doing business inside the city limits of Portland are downsides that have pushed some owners to tertiary markets or out of state. Others see the tax law changes, an ongoing influx of residents and continued business expansion as positive reasons to stay the course in a market with prolonged opportunities for building wealth.

With rents flattening and vacancies increasing, what otherwise could have been a year of “holding tight” on investment properties was instead a hectic one. As we examine in this newsletter, the combination of increased market regulation, rising interest rates, and the cost of doing business inside the city limits of Portland are downsides that have pushed some owners to tertiary markets or out of state. Others see the tax law changes, an ongoing influx of residents and continued business expansion as positive reasons to stay the course in a market with prolonged opportunities for building wealth.

Since 2013, Oregon and SW Washington have seen the economy gaining steam. In 2017, the metro area saw improvements in wages and income. And, after decades of trailing behind, a recent Census Bureau report indicates that wages in Oregon are now on par with the national median.

Government Intervention

Continued in-migration, changing demographic preferences, and lack of adequate supply caused Portland (2015) and Vancouver (2016) to declare housing emergencies.

Similar declarations were adopted by the City of Milwaukie (2016) and Josephine County (2017). Mayor Wheeler recently proposed—and the City Council agreed—to extend this emergency into 2019. Our political leaders have tried unsuccessfully to rectify the region’s housing shortage through the implementation of fees for landlords and developers as a way to circumvent statewide restrictions on rent control. These disincentives may only serve to continue the housing emergency far into the future—although this time they decided to have city staff calculate what benchmarks constitute an end to this ongoing crisis.

Market Vacancy and Rents

The market has begun to see some softening. The Multifamily NW Fall Apartment Reports recorded the area 2016 vacancy rate at 3.71%, the fall 2017 rate at 4.37%, and the fall 2018 rate at 4.4%.

Rent per square foot has continued its upward climb, although at a slower pace than recent years. Multifamily NW data indicated 2017 year-over-year rent increases of 6.37%.

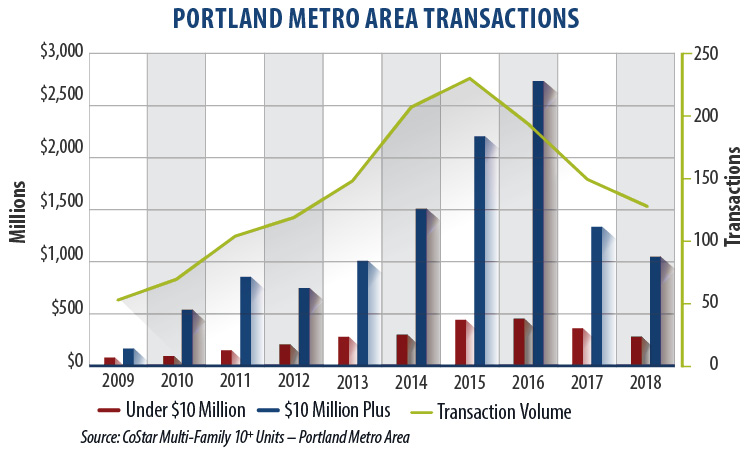

Institutional Transactions of ($10 million and up):

In 2017, there were 37 apartment transactions priced over $10 million. Through the end of October 2018, there have been 26 apartment transactions priced over $10 million. In dollar volume, these 26 transactions accounted for almost $1.05 billion in sales. This is slightly below the pace seen in 2017, which saw approximately $1.31 billion in sales volume for institutional sales. As in 2017, many of 2018’s institutional sales to date have been in the suburbs surrounding Portland.

Institutional transactions this year include:

- Thorncroft Farms; 340 units in Hillsboro sold for $97.5 million; $286,765 per unit

- Vancouvercenter; 84 units in Vancouver sold for $14.5 million; $172,896 per unit

- Susan Marie Apartments; 89 units in Aloha sold for $13.2 million; $148,315 per unit

- Tessera; 304 units in Hillsboro sold for $85 million; $279,605 per unit

- Axcess 15; 202 units in Portland sold for $66 million; $326,733 per unit

- Columbia Trails; 264 units in Gresham sold for $52.3 million; $198,000 per unit

- Binford Garden Townhomes; 172 units in Portland sold for $30.8 million; $179,070 per unit

- Red Tail Canyon Condos; 78 units in Portland sold for $18.4 million; $235,897 per unit

Non-Institutional Transactions (under $10 million)

Turning to Portland metro non-institutional transactions below $10 million, we have seen roughly 100 transactions through the end of October that accounted for over $359 million in dollar volume. This is trending slightly above what the Portland market experienced last year. In 2017, 113 transactions in the metro area below $10 million accounted for over $380 million in dollar volume.

Permits

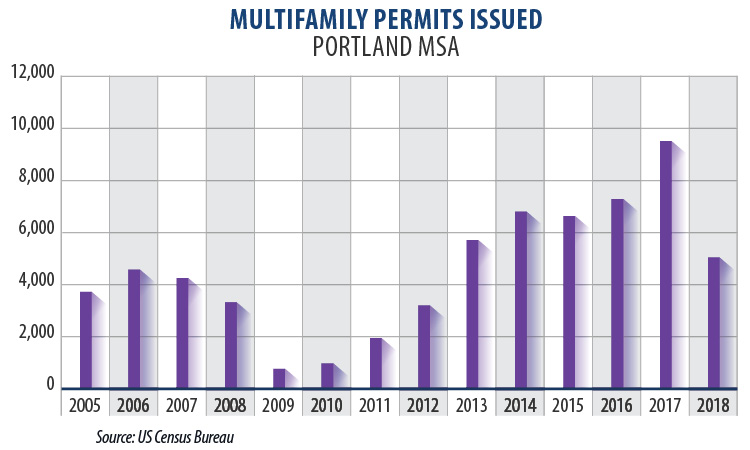

Portland Metro Area permits for 5+ units have risen steadily from a low of 1,007 units permitted in 2009 to 9,979 in 2017, and 7,048 in 2018.* Still, experts say housing has not accelerated enough to meet currently estimated regional demand of 27,000 affordable units.

Inclusionary Housing

Since Portland’s new Inclusionary Housing requirement went into effect in February 2017, only 36 market rate projects and a handful of affordable projects of at least 20 units have submitted building permit applications.

In September, the City published an 18-month review of the program and reported 362 affordable units in the pipeline within privately financed projects.

So far, city leaders appear relatively unconcerned by this drop-off in permitting activity. The City reports that 8,294 pre-inclusionary housing units remain in the pipeline.

What, me worry?

Governments appear to be adopting policies to resolve the issue of affordable housing but are going in the wrong direction. Experts interviewed this year continue to report that our housing issue can best be solved by enticing development rather than constricting it. Ironically, we also believe that current city policy will continue to benefit multifamily investors by continuing to shrink the development pipeline and leading to reducing vacancy rates, reduction of concessions, and speedier absorption of new units.

As we have said for the last seven years, the Greater Portland Area’s apartment market is still booming. We’re headed downriver somewhere, but we can’t foresee how much more tinkering with the free market our politicians will take up—we’re not sure exactly where we’ll end up.

But no matter what the market, our top priorities will continue to be providing you with excellent value while collaborating with you on building your legacy over the long-term.

Cody Hagerman and Rob Marton are partners at HFO. They can be reached by phone at (503) 241-5541 or by e-mail at cody@hfore.com or rob@hfore.com.

*Data from CoStar and HFO Research.